News & Blogs

Home/Blogs

How Long Does Closing on a House Take?

- Real Estate Industry

- # April 28, 2025

- # 469 Views

Have you ever felt that the whole process of buying a house takes so much patience that it feels as if you are waiting for the “pot to boil”? You put in an offer, sign a big pile of papers, wire the earnest money, and then… the waiting begins.

In the case you are an investor, the longer you wait for the closing procedure the more money you will have to pay for the holding cost, the more you will be exposed to the risk, and your potential for profit will go down. Hence, the question arises: How long does it take to close on a house? Is there a magic formula, or is every deal with its own character?

Let’s pull back the curtain and see what’s really going on.

The Waiting Game: Why Speed Matters for Investors

It’s a fact that should not be overlooked: property is not a game of quick moves. The industry has a long-standing reputation for the slowest of “wait your turn” times, excessive documentation, and delays in the process. However, for those with money to invest, it is not just a question of time but also of tactics.

Working quickly through the closing, you increase your chances of discussing with the seller a lower price, being among the first to access a good deal, or gaining an advantage over the competition. In contrast, a delayed closing can reduce your profits, immobilize your funds, and cause you to lose the next opportunity.

And here’s the thing: while agents love to quote “30 to 45 days” as the standard, the honest answer is, “It depends.” Some deals close in a week. Others drag on for months. The difference? It usually comes down to financing, paperwork, and the people involved

So, What’s the Real Timeline?

To be more precise, the latest information (ICE Mortgage Technology, in case you need proof) suggests that the typical time to close a home buying transaction is around 44 days. Still, it is important to keep in mind that “averages” can be misleading. What about an investor who purchases an asset with cash?

In that case, it is often a deal that can be closed in only ten days or less if all parties involved are well-prepared. Suppose the buyer depends on an FHA, VA, or USDA loan; the period could exceed 60 days.

Here’s why:

- Cash buyers: No lender, no underwriting, no waiting for appraisals. Just title, inspection, and you’re done.

- Financing: Every lender has their process, and some are faster than others. Underwriting can be lightning-quick or painfully slow.

- Title issues: A clouded title or old lien? That can stall things for weeks.

- Inspections and appraisals: Backlogs happen, especially in busy seasons.

So, while “30 to 45 days” is a decent ballpark, don’t bank on it, especially if you’re juggling multiple deals or working with unique properties.

The Step-by-Step Reality: Where Deals Get Stuck

Imagine the closing process as a relay race. Every stage gives the next one, and the whole team is affected if one runner falls.

- Contract Signed, Earnest Money Down:

You and the seller both sign the deal, and your good faith money is placed in escrow. It is your “game with your own skin”.

- Loan Terms Negotiated (if you’re financing):

You agree on rates, bargain for discounts, and have your financier agree with you. Expert advice: Even if you are an experienced investor, make comparisons.

- Paperwork:

Tax returns, bank statements, proof of funds, and rental history. The quicker you submit, the quicker you move.

- Appraisal & Inspection:

The appraisal is ordered by the lender; you arrange the inspection. Either one of them can be a quick process or not. If the inspector discovers some issues, you can expect additional negotiations.

- Renegotiation (sometimes):

In case the examination reveals unexpected things, you may request some repairs or money instead. Or, like most investors, you could just give a complacent smile and buy the property without making any changes at a lower rate.

- Underwriting:

One of the people who oversees the credit process at the bank goes through every bit of information. They will definitely be on the lookout for additional documents to be provided.

- Title Search:

The title company investigates if there are any liens, past claims, or if the property has any hidden issues. If there is not a clean title, then the deal will not go through.

- Final Prep & Closing Disclosure:

First of all, you receive a thorough explanation of the expenses. Legally, you should have a look at it no less than 72 hours prior to closing.

- Final Walkthrough:

Just one more check to be certain that the properties are as expected.

- Settlement:

You sign the documents and funds are transferred. The keys are handed to you.

Sounds easy, doesn’t it? However, each step may be a potential obstacle for your journey. In some cases, it can be a missing document. In other situations, a repair is done at the last minute. And at times it can be just someone on vacation.

What Really Slows Things Down?

Let’s be real: delays happen. Here are the usual suspects:

- Financing Fumbles: Underwriters get picky. Loan officers disappear. Docs go missing.

- Title Surprises: Old liens, unpaid taxes, or a long-lost heir popping up.

- Inspection Drama: Mold, roof leaks, or a busted furnace can trigger new negotiations.

- Insurance Issues: Especially in flood or fire zones, quotes can take time.

- Unresponsive Parties: One slowpoke can hold up the whole show.

And sometimes, it’s just a missing signature. Seriously. One unsigned page can push your closing back days.

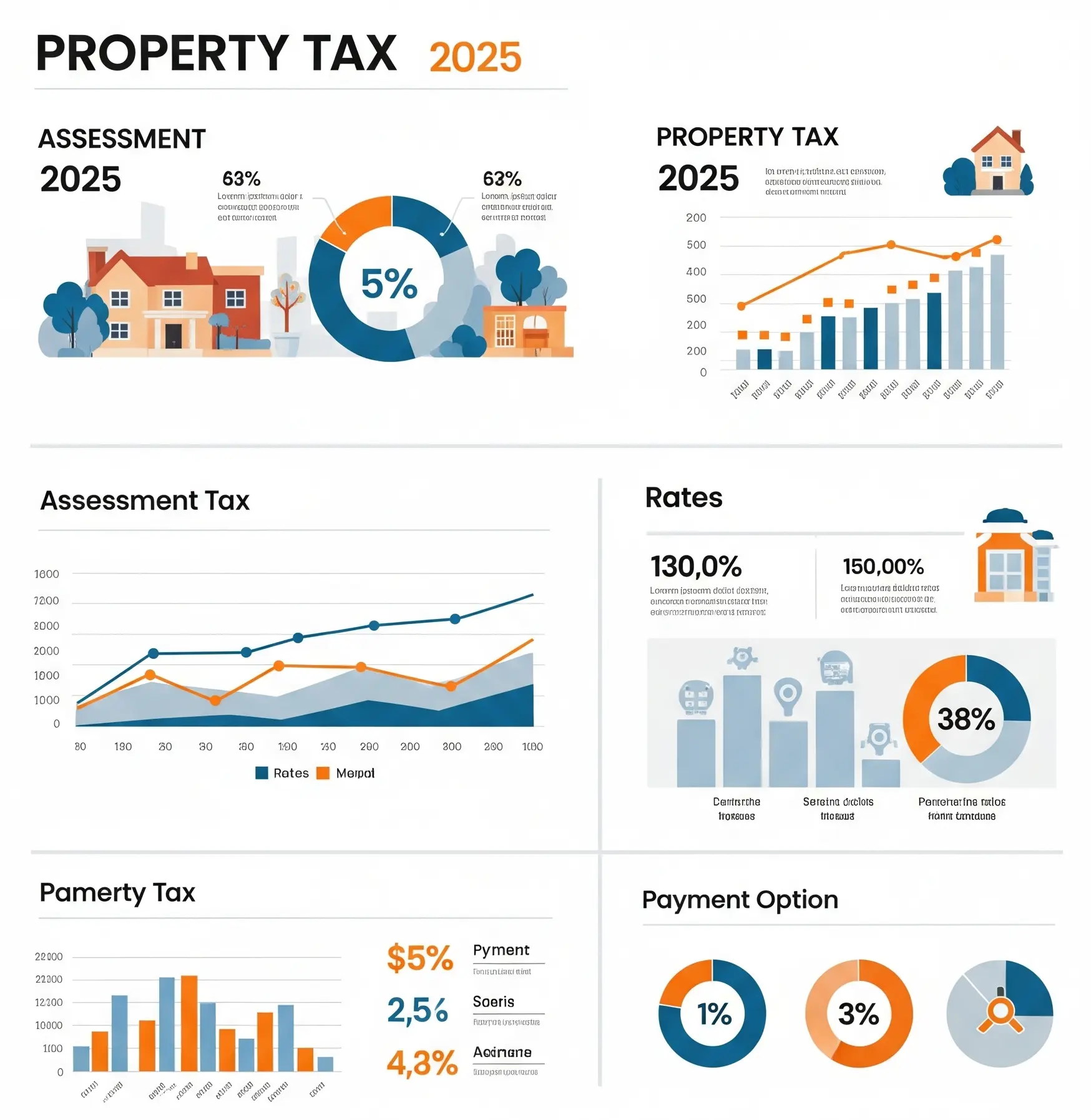

The Money Side: Closing Costs and Sneaky Surprises

Numbers are what we should discuss. Not only closing quite slow, but it also comes with a hefty price. Be prepared to pay between 2% and 5% of the buying price as your closing costs. If you were to have a $200,000 property, that amount would be somewhere between $4,000 and $10,000, and in some cases, even more.

Where does it all go?

- Appraisal & Inspection Fees

- Title Insurance & Search

- Escrow Fees

- Lender Fees (origination, underwriting, “junk fees”)

- Prepaid Taxes & Insurance

- HOA or Condo Fees (if applicable)

- Transfer Taxes & Recording Fees

- Initial Repairs (for the fix-and-flip crowd)

- Cash Reserves (lenders often require a cushion)

And don’t forget those “nickel-and-dime” charges like courier fees, admin fees, and wire fees. It adds up. The first time you see an itemized closing disclosure, you might do a double-take.

How to Close Faster: Real-World Tips for Investors

Want to shave days (or weeks) off your closing? Here’s what works:

- Go Cash, If You Can:

No lender, no delays. Cash is king for speed

- Be Lightning-Fast with Docs:

The sooner you send paperwork, the fewer excuses anyone has to stall.

- Work With Pros:

A sharp agent, a responsive title company, and a lender who knows investors can make all the difference.

- Get Pre-Approved, Not Just Pre-Qualified:

Underwriters move faster when they already have your info.

- Schedule Inspections Early:

Especially in busy seasons, inspectors get booked up.

- Double-Check Everything:

Don’t let a missing signature or typo hold you up.

- Set Clear Expectations:

Communicate your timeline to everyone: seller, agent, lender, and title. Surprises slow things down.

Final Thoughts: Control of the Controllables

So, what is the typical duration for house closing? The investors are usually the ones who can decide how fast or slow the process will be. Hence, they can close a house in a week, a month, or even remain waiting for a long time if the universe is against them.

It all comes down to the knowledge of the procedure, being well planned and doing business with the people who understand the value of your time as much as you do.

We have experienced all sorts of unexpected events during the closings. Regardless of whether you are intending to grow your portfolio or just want your next flip to be done quickly, we are the ones who will support you in keeping your transactions on the right track and your profits at the top.

Ready to close faster and smarter? Let’s get you moving. StreamlineREI: Your partner for smooth, speedy closings-every time.

Frequently Asked Questions

How long does closing take for cash buyers vs. financed deals?

Cash buyers often close in 7–10 days (sometimes faster) since there’s no lender involvement. Financed deals (FHA, VA, USDA) typically take 45–60+ days due to underwriting, appraisals, and lender requirements.

Can I close faster than 30 days as an investor?

Yes, if you’re paying cash, have prepped documents, and work with a responsive team. Some deals close in 5–7 days if the title is clean and inspections are expedited. Financed deals? Rare, but possible with a streamlined lender.

How do title issues slow things down?

A “clouded” title (e.g., unresolved liens, heir disputes) requires legal resolution before closing. Title companies may need weeks to clear these, especially if negotiations or court filings are involved.

Are there hidden fees beyond closing costs?

Yes! Beyond the standard 2–5% of the purchase price, watch for “junk fees” (lender admin charges), rush fees for appraisals, or last-minute repairs. Always review your Loan Estimate and Closing Disclosure line-by-line.

How can investors negotiate a shorter closing timeline with sellers?

Be transparent upfront. Offer flexible terms (e.g., quick close in exchange for a slightly higher offer) or reassure sellers with pre-approved financing and a clean earnest money trail. Building trust speeds up cooperation.