News & Blogs

Home/Blogs

Exploring High-Growth Real Estate Markets for Profits

- Real Estate Industry

- # May 6, 2025

- # 469 Views

Want to make smart money in real estate? It is not just about buying property but about where you buy it. Some places are like fertile ground for your investment. They are set to grow faster than others. These spots are called high-growth real estate markets. Finding them is key to making more profit.

In 2025, the real estate world keeps shifting. Interest rates, building new homes, and where people want to live all play a part. If you want your real estate investments to do well, you need to look at markets that show strong signs of future growth. This guide will help you understand what makes a market grow fast. It will give you ideas for where to invest your money to get better returns.

What Does “High-Growth Real Estate” Really Mean?

When we say a real estate market has “high growth,” it means properties there are likely to go up in value quicker than the average place. Rents might also rise faster. It is a place where the number of people wanting to buy or rent is increasing steadily.

Think of it like this: more people wanting something usually makes that thing more valuable. In real estate markets, more people wanting homes means property values tend to climb. High growth is often a sign of a healthy, strong local area.

How to Spot a Real Estate Market Ready to Grow

You can look for clues to find these promising real estate markets. Certain things happening in a city or region signal that it is likely to grow.

Is the Number of People Growing?

This is a significant clue. Are lots of people moving into the area? When the population grows, these new residents need places to live. This creates more demand for both homes to buy and places to rent. Population growth and real estate values are very closely linked. Cities that see many new people arriving often become property value growth areas.

How is the Job Situation?

Are there plenty of jobs in the area? Are businesses hiring? Is the unemployment rate low? A strong job market pulls people in. It also means residents have money to spend, including on housing. Places with growing economies tend to have growing real estate markets.

Can People Afford to Live There?

Even with job growth, if housing costs are too high, things can slow down. Look for markets where homes are still relatively affordable compared to incomes. Affordable investment locations can attract people leaving more expensive cities. This can fuel future demand and growth.

Do People Rent There?

If you plan to buy property to rent out, you need renters! Check how many people rent in the area. Are rental vacancy rates low? Are rents going up? Strong rental demand means you are more likely to find tenants. It points to good potential for rental yield hotspots.

Is the Area Improving?

Look for signs of investment in the community. Is the city building new parks, roads, or public transport? Are there new businesses or shopping areas coming? Is new housing being built? These improvements make the place more attractive. They can turn up-and-coming neighborhoods into desirable spots.

“Find places where life is improving, and opportunity is increasing,” suggests a longtime real estate writer. “That’s where people will go and where real estate will follow.”

What About the Big Picture?

What do the experts say about the U.S. real estate market forecast for 2025? Things are a bit mixed, but there is still potential.

We have seen some slowing after a period of very fast growth. Higher interest rates mean buying a home costs more each month. This has caused some buyers to wait. However, there are still not enough homes for everyone who wants one in many parts of the country. This low supply helps keep prices from falling much.

Predictions for 2025 suggest that home prices might not rise as fast as in the last couple of years. But most forecasts do not expect big drops either. It looks like a market where finding the correct location is more important than ever for investors. You need to find markets with strong local reasons to grow. These are the high-growth real estate markets that stand out.

Places to Watch: High-Growth Real Estate Markets for 2025

Based on the factors we talked about and recent market information, some areas are often named as having good potential for investors in 2025. These are the best real estate markets to invest in 2025 or profitable real estate areas that experts point to.

Many of these are in the southern part of the United States, known as the “Sun Belt.”

Here are some examples of cities or regions showing promising signs:

- Texas Cities

- Florida Markets

- Southeast Growth Areas

- Mountain West Spots

- Select Midwest Cities

These are just a few examples. There are many other places showing potential. Each city is different. You must look closely at the local details. These places are often mentioned as top cities for real estate investment or high-return real estate locations in 2025.

What Makes These Specific Real Estate Markets Shine?

Let’s look at why these areas are often seen as potential high-growth real estate markets in 2025.

- Texas

- Florida

- Charlotte, NC

- Nashville, TN

- Atlanta, GA

Understanding these specific reasons for growth is essential. It helps you judge if the growth is likely to last.

How Can You Invest in These High-Growth Areas?

Once you have found a market that looks promising, what can you do?

- Buy Rental Properties: Purchase homes or apartments to rent out. In a growing market, you might see rents increase over time. This can give you a steady monthly income. Look for rental yield hotspots where the rental income looks good compared to the price you pay. These are often the best places to buy a rental property in 2025.

- Fix and Flip Homes: Buy houses that need repairs at a lower price. Fix them up and sell them. In a market where values are rising, you can potentially sell for much more than you paid and spent on fixing. This strategy relies heavily on real estate appreciation trends.

- Hold for the Long Term: Buy a property and keep it for many years. The goal is to benefit from the overall property value growth in areas over time. This is a less active way to invest.

- Wholesaling (as discussed before): Find a property, get it under contract, and sell the contract to another investor. Doing this in a high-demand market can make it easier to find a buyer quickly.

The best way to invest depends on how much time and money you have. It depends on your comfort with risk.

Learning the Numbers: Appreciation and Cap Rates Made Simple

Two numbers are talked about a lot when looking at real estate markets: appreciation and cap rate. Let’s make them simple.

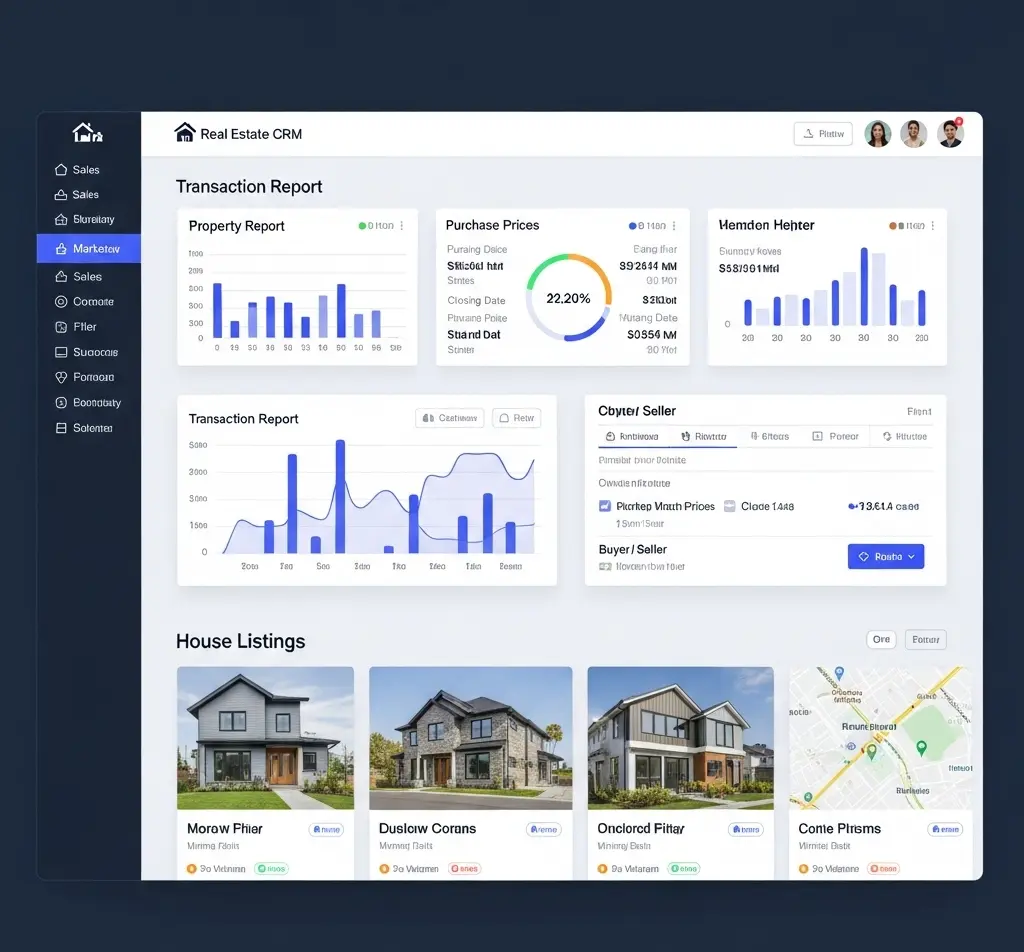

- Real Estate Appreciation Trends: This is how much a property’s value goes up. If you buy a property for $300,000 and it is worth $330,000 a year later, it has appreciated by $30,000 or 10%. High-growth markets often have strong appreciation trends. This is key if your main goal is for the property value to increase.

- Cap Rate Trends: This number helps investors compare rental properties. It shows the expected yearly income from rent (after some costs but not including the mortgage) compared to the property’s price. A higher cap rate usually means the property might give you more cash from rent each year for the price you paid. Cap rate trends show if rental returns are getting better or worse in a market. It helps you find real estate markets with the highest ROI 2025 from rentals.

Checking these numbers helps you see the potential for diverse types of profit in different markets.

Finding Good Deals in Growing Markets

Even in a market that is growing fast, you still need to find the right property at the right price.

- Affordable Investment Locations: Look in parts of the city that are cheaper but are near areas that are already doing well. They might be next in line for growth.

- Up and Coming Neighborhoods: These are areas that are improving. Old buildings are being redone. New shops or parks are coming. These neighborhoods can offer a chance to buy in before prices get too high. They can become significant property value growth areas.

Finding these specific spots within a larger growing market takes local research.

Your Guide to Investing in High-Growth Markets (Simple Steps)

Are you thinking of investing in a high-growth real estate market in 2025? Here is a basic real estate investor guide:

- Know What You Want: What are your financial goals? Do you want monthly income or for the property value to grow a lot over the years?

- Research Deeply: Go beyond just reading a list of cities. Look up local job stats, population changes, income levels, and future plans for the town. Check local selling prices and rental rates.

- Visit the Area: If you can, spend time in the market you are thinking about. See what it feels like. Drive around different neighborhoods. Talk to people who live there.

- Connect Locally: Find real estate agents, brokers, or property managers who work directly in that market. They know the local scene best. Talk to other investors in the area.

- Look at the Numbers (Again): For any property you like, check its price compared to others nearby. Figure out potential rental income and costs. Make sure the numbers work for your goals.

Smart investing means doing your homework. Finding the right real estate markets is a big part of being successful. StreamlineREI has tools and resources that can help real estate investors research and manage properties.

Risks to Keep in Mind

No investment is a sure thing. High-growth real estate markets also have risks.

- Growth Can Slow: The reasons a market is growing can change. A major employer might leave. Economic problems can happen. This can slow down or stop property value increases.

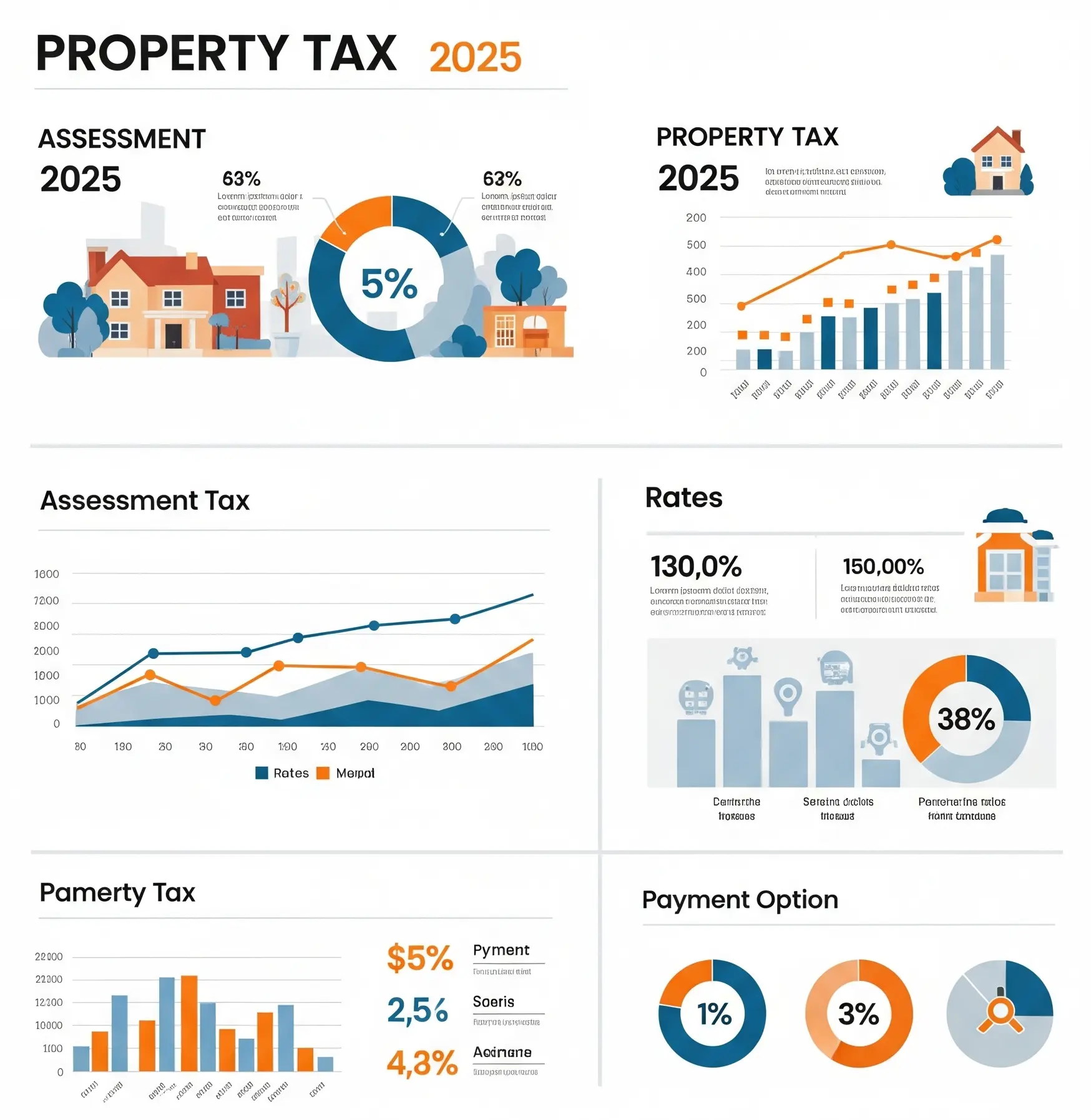

- Costs Go Up: Owning property costs money. Property taxes can rise in growing areas. Insurance costs might increase. Repairs always come up.

- Renter Issues: If you rent, finding good tenants can be hard sometimes. Vacant properties mean you lose money.

- Market Changes: Unexpected things can happen in the economy or with interest rates. These can affect the whole market.

Thinking about these risks helps you make careful decisions.

Finding Profit in 2025 Real Estate Markets

Investing in high-growth real estate markets offers exciting chances to maximize your profits in 2025. While the national housing picture might see changes, specific real estate markets with substantial job numbers, growing populations, and relative affordability are likely to keep performing well. These are the high-growth real estate areas that investors should look at closely.

Finding the best real estate markets to invest in 2025 takes work. Look for the signs of growth: more people, more jobs, affordability, and rental demand. Research cities and regions showing these traits. Learn about real estate appreciation trends and cap rate trends. Find affordable investment locations and up-and-coming neighborhoods.

By doing your research, connecting with local people, and understanding the numbers, you can find opportunities in these dynamic real estate markets. This gives you a better chance to grow your money through property investment this year and in the future.

Frequently Asked Questions

Is property value growth in areas the only way to make money?

No. You can also make money from rental income (cash flow) if you buy rental properties. This is especially true in rental yield hotspots. Some investors focus more on monthly income than on how much the property value goes up.

How can I tell if a neighborhood is “up and coming”?

Look for signs like buildings being renovated, new small businesses opening (coffee shops, restaurants), improvements to parks or streets, and younger people or artists moving in. Check local news for planned development projects. These can be clues that an area is starting to improve and could become a future property value growth area.

What is ROI in real estate?

ROI stands for Return on Investment. It is a way to measure the profit you make on an investment compared to how much money you put in. Investors look for real estate markets with the highest ROI 2025 potential, meaning markets where they expect to get a good return on their money through rent or appreciation.

Is it riskier to invest in emerging property markets?

Often, yes. Emerging markets can offer higher potential for fast growth because they are starting from a lower point. However, they can also be less stable than established markets. There might be less data available, and the growth drivers might be less proven. Higher potential return often comes with higher risk.

How does population growth affect rental yield hotspots?

As the population grows, more people need places to live, including rentals. This increased demand for rentals can allow landlords to charge higher rents, which can lead to better rental yields for investors. Population growth and real estate rental income are intricately linked.