News & Blogs

Home/Blogs

How to Invest in Wholesale Real Estate Today with No Money

- Real Estate Industry

- # May 8, 2025

- # 469 Views

Have you ever wanted to get into real estate? Do you dream of making money from property? Many people do. But they think you need a huge amount of cash to start. That is not always true. There is a way to work in real estate without needing your own money for the purchase. This is called wholesale real estate, and if you want to invest in wholesale real estate today, you are living in an ideal time.

In 2025, wholesale real estate remains a smart way to start. It lets you get into the property market. You do this without taking on big loans. It lowers your risk a lot. This guide will show you how to invest in wholesale real estate with no money today. We will cover every step clearly. Even if you are new, you can grasp this.

What Exactly is Wholesale Real Estate?

Let’s keep it simple. Think of yourself as a middle person. You find a property that someone wants to sell fast. This seller is often motivated. Maybe they need cash quickly. The house needs a lot of work. You agree to buy the property from them at a low price. You sign a contract saying you will buy it.

Here is the key: You do not plan to buy it yourself. Your plan is to find another buyer. This second buyer is often a real estate investor. They have the money to fix up the house. Or they want to keep it as a rental. You sell them under the contract you have with the first seller. You sell it for a bit more than you agreed to pay. The difference is your profit. This is your wholesale fee.

You never actually own the house. You just have the right to buy it for a short time. You pass that right to someone else. That is the heart of the real estate wholesaling business model.

Why Try Wholesaling with No Money?

Starting out in real estate investing with no capital sounds too good to be true, right? But with wholesaling, it is possible. Here is why it is a popular path, especially for beginners:

- Low Risk: Since you do not buy the property, you avoid big debts. You are not on the hook for mortgage payments. You do not pay for repairs. This is very different from traditional flipping houses.

- Less Money Needed Upfront: While “no money” means no purchase money, you do need a tiny bit for things like marketing or a small deposit. But it is far less than a down payment on a house. The goal is to have zero-cost real estate deals in terms of the final purchase.

- Quick Process: Wholesaling deals often close fast. Sometimes in days or weeks. This means you can make money quicker than waiting months for renovations and sales.

- Great Learning: You learn the real estate market fast. You learn how to find deals. You learn how to talk to sellers and buyers. It is a crash course in the real estate world.

Key Ideas for No-Money Wholesaling

To make wholesaling work without your funds, you need to understand a few things.

What are Motivated Sellers?

These are property owners who need to sell fast. They might be facing tough times. Think about people dealing with:

- Foreclosure

- Divorce

- Job loss

- Moving quickly for a job

- Inheriting a property, they do not want

- Owning a house that needs huge repairs, they cannot afford

Motivated sellers often care more about speed and ease than getting the highest dollar. This is where a wholesale real estate offer can help them. They get a quick sale. You get a property at a price low enough to interest another investor.

Finding Distressed Property Leads and Off-Market Real Estate Deals

These are properties not listed on the leading real estate websites (like the MLS). Why look here? Less competition. Sellers might be more open to selling below market value. Distressed properties often need repairs. This makes them perfect for investors who want fixer-uppers.

Finding these takes effort. It is not as easy as looking online. But the rewards can be much bigger.

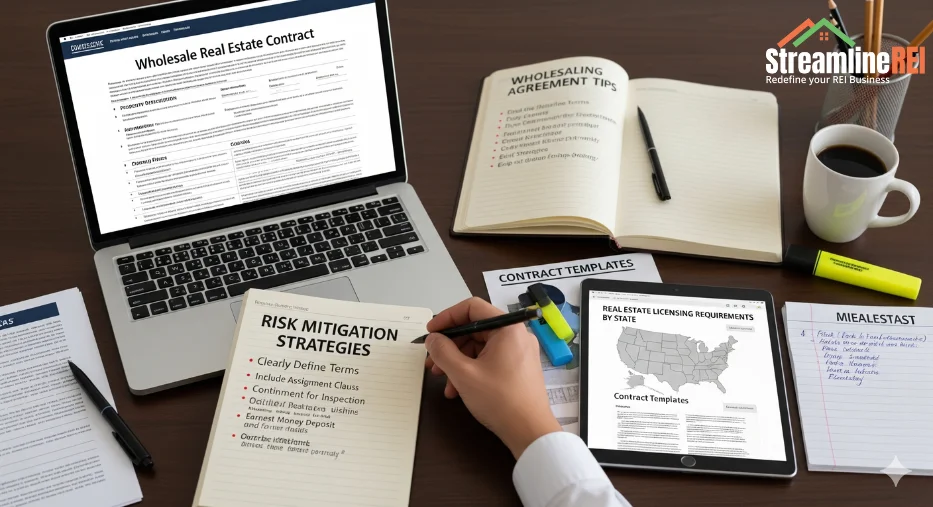

Understanding Assignable Contracts in Real Estate

This is the paperwork magic of wholesaling. When you sign a purchase agreement with the seller, you make sure it is “assignable.” This means you have the right to sell your position in that contract to someone else. You are assigning your rights and duties to a new buyer.

The contract might say “Buyer Name and/or assigns.” This simple phrase is powerful. It gives you the flexibility to find your end buyer.

Building a Cash Buyers List

Who buys these contracts? Real estate investors with cash. They do not need bank loans. They can close fast. These are your customers. You need a list of these people. A good cash buyers list is super important for wholesale real estate success.

Double Closing Real Estate (Optional, More Complex)

Sometimes, instead of assigning the contract, you might do a double closing. This means you briefly buy the property. Then, you immediately sell it to your end buyer moments later. This usually requires transactional funding. This is short-term money to help you buy it, often for just one day. It is more complex and might need a bit of money for closing costs or lender fees, so assignment is usually the no-money strategy.

Your Step-by-Step Guide: How to Wholesale Real Estate in 2025

Okay, let’s break down the process. Here is how to start wholesaling real estate step by step, even with no money.

Step 1: Get Educated About Your Local Market

You must know your area. What are houses selling for? Which neighborhoods are hot for investors? What kind of repairs do houses in your area typically need? How much do those repairs cost?

Learn property values. Look at what houses sell for after they are fixed up (the After Repair Value, or ARV). Understand local trends. This knowledge helps you spot good deals. It helps you talk smartly with sellers and buyers. Wholesale real estate requires market knowledge.

Step 2: Build Your Network

Connect with people in real estate. Find other investors. Talk to real estate agents. Connect with contractors. Find a good title company or closing attorney. These people can offer advice. They can become part of your cash buyers list. They can help you close deals.

Finding a mentor who has done wholesaling can be a game-changer. They can guide you.

Step 3: Finding Properties (REI Lead Generation)

This is where you find motivated sellers and distressed property leads. This is key to zero-cost real estate deals. You are looking for people who NEED to sell.

- Drive for Dollars: Drive through neighborhoods. Look for houses that seem neglected. Long grass, peeling paint, boarded windows. Write down the addresses. Find the owner’s contact information later.

- Direct Mail: Send letters or postcards to owners of properties that fit your criteria. Think absentee owners (people who own a house they do not live in), owners with code violations, or those behind on taxes. Your message should offer a solution to their problem (“We buy houses fast for cash”).

- Online Search: Look at websites for foreclosures, probate notices, or tax delinquent lists. Sometimes, you can find off-market real estate deals here.

- Networking: Tell everyone you know you are looking for properties. Sometimes, friends or family know someone who needs to sell.

Focus on finding motivated sellers. They are the source of your deals.

Step 4: Analyze the Deal Quickly

Once you find a potential property, you need to act fast. Can you make money from this?

Estimate the ARV (After Repair Value). What will the house be worth after it is fixed? Estimate the repair costs. How much work does it need?

A common rule is the 70% rule: Investors usually want to pay no more than 70% of the ARV minus the cost of repairs.

Maximum Offer = (ARV x 0.70) – Estimated Repairs

Your offer to the seller needs to be below this maximum offer. This leaves room for your profit and the end buyer’s profit/costs.

Step 5: Contact the Seller and Make an Offer

Reach out to the motivated seller. Be kind. Listen to their situation. Understand their needs. Explain how you can help them sell their house quickly.

If the numbers work, make an offer. Your offer should be fair, given their need for fast sales and the property’s condition. If they agree, sign a simple purchase agreement. Make sure the “and/or assigns” clause is in the buyer section. This is your assignable contract in real estate. Set a closing date that gives you enough time to find a buyer (often 30 days or less).

Step 6: Find Your Cash Buyer

As soon as the seller signs the contract, start finding a buyer! This is where your cash buyers list comes in.

- Reach Out to Your List: Contact investors you know. Tell them about the property. Share the details, pictures, and your asking price (which is your contract price plus your fee).

- Network More: Go to local real estate investor meetings (REIAs). Post the deal online (carefully, following the rules). Talk to other wholesalers.

- Market the Deal: Put out signs (check local rules!). Advertise online in investor groups.

Show them the potential profit. Highlight the low price and the property’s features.

Step 7: Assign the Contract

When you find an interested cash buyer, you sign an Assignment of Contract document. This is a simple paper. It says you are transferring your rights to the new buyer from the original purchase agreement. The new buyer agrees to step into your place. They will buy the house from the original seller on the agreed-upon date and price.

The assignment contract also states the fee the new buyer will pay you to offer them these deals. This is your wholesale profit.

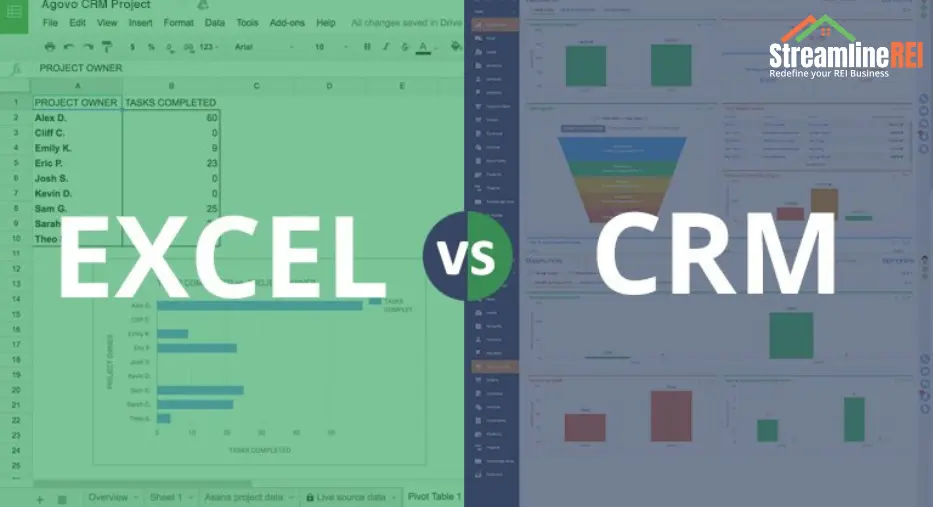

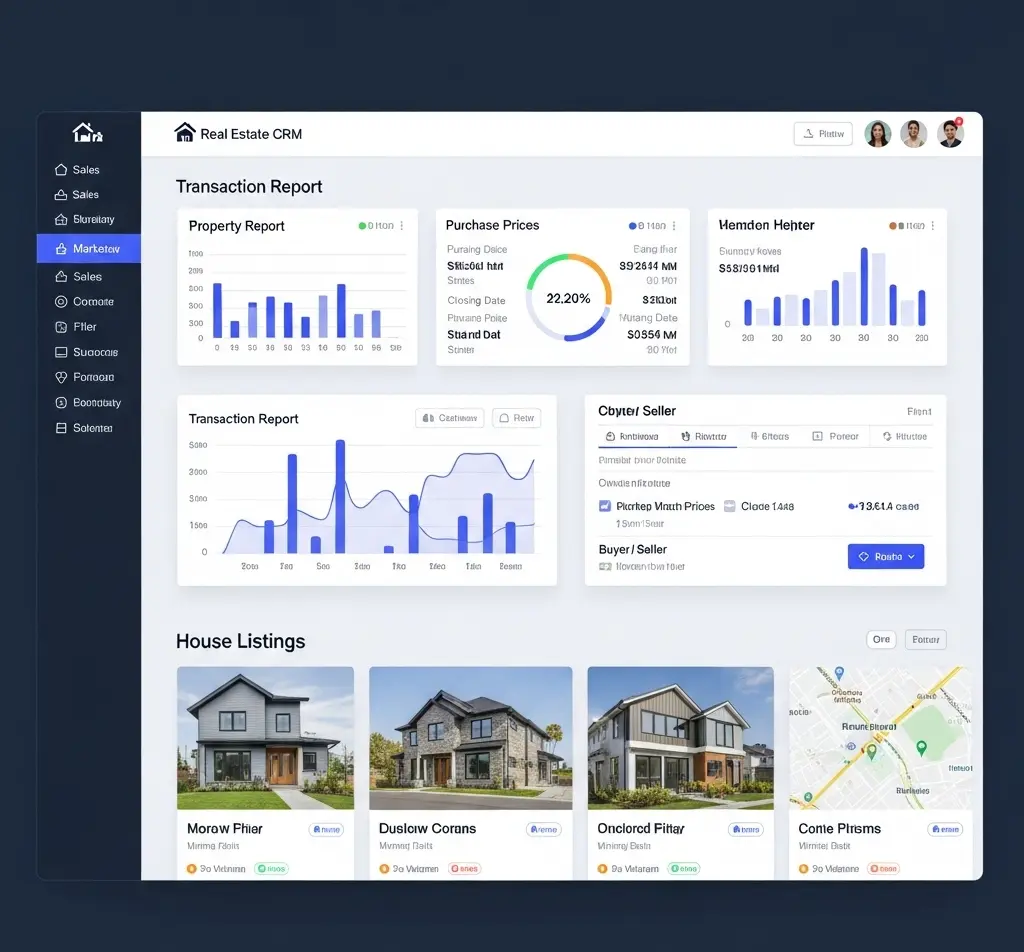

It is worth noting that StreamlineREI offers tools that can help manage these leads and deals more effectively.

Step 8: Close the Deal and Get Paid

The new cash buyer works with the title company or attorney you chose. They handle the closing process. On closing day, the cash buyer brings the full purchase amount (the price in your original contract plus your assignment fee). The title company pays the original seller their money. They also pay you your assignment fee directly. The cash buyer gets the deed to the property. You walk away with your profit, having never used your own money to buy the house.

This wholesale real estate step-by-step process shows how you can complete the transaction.

Virtual Wholesaling Real Estate

The steps are similar for virtual wholesaling. This is when you wholesale properties in a market you do not live in. You do all the steps remotely. This means more online research and building a network in that specific distant market. You rely heavily on technology and local contacts (like agents or photographers) in the target area.

Challenges You Might Face

While wholesaling with no money is possible, it is not always easy.

- Finding Motivated Sellers: It takes consistent effort and marketing. REI lead generation is key here.

- Analyzing Deals Correctly: You need to learn how to quickly size up a property’s value and repair costs.

- Finding Cash Buyers Fast: You need a strong buyers list that is ready to go. Time is short once you have a property under contract.

- Legal Issues: Laws about wholesaling vary by state and city. You need to understand the rules in your area. Working with an investor-friendly title company is wise. Some areas might require you to be licensed, or they have specific rules about assigning contracts. Always check local laws.

“Success in wholesaling comes down to your hustle and how well you connect people,” says a seasoned investor we spoke with. “It’s about solving problems for sellers and providing opportunities for buyers.”

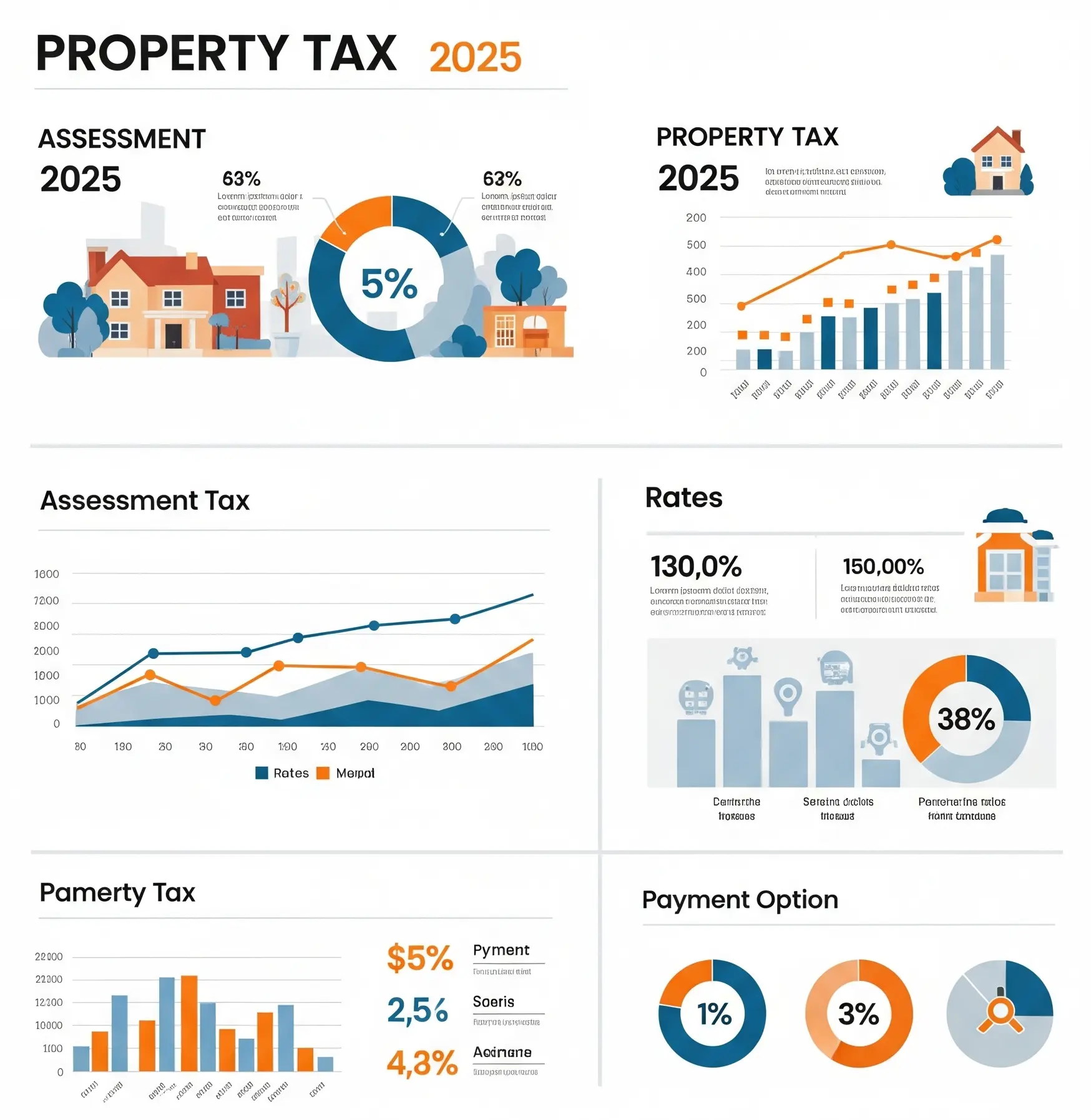

The Real Estate Market in 2025

What does 2025 look like for wholesalers? Market conditions are always changing.

We see continued interest from investors in finding properties that need work. Higher interest rates might mean fewer regular buyers, which can sometimes lead to more motivated sellers needing to sell quickly. Distressed property leads might become more common.

Trends like remote work continue to shift where people want to live. This can open new markets for virtual wholesaling. Investors are also using more data and technology to find deals and analyze properties. Leveraging these tools can give you an edge in real estate investing with no capital upfront for the purchase itself.

“Even with shifts, the core need remains,” notes a market analyst. “There will always be sellers who need speed and buyers looking for value. That’s the wholesaler’s sweet spot.”

Using platforms that help organize leads and deals can be helpful. You might explore how StreamlineREI could assist in managing your wholesaling efforts.

Benefits of Starting This Way

Starting with wholesale real estate allows you to:

- Get into real estate without needing lots of your savings.

- Learn the business from the inside out.

- Build valuable connections.

- Potentially make profits quickly.

- Avoid the debt and costs of owning property directly.

It is a wonderful way to build experience and capital. You can use the money you make from flipping contracts to invest in other ways later, even buying and holding rental properties.

Conclusion

Starting in wholesale real estate with no money is a real path. It needs challenging work. It needs learning. But you can do it. Focus on finding motivated sellers. Build your cash buyers list. Understand the simple steps: find the deal, get it under contract (assignable!), find a buyer, assign the contract, and get paid.

In 2025, the opportunities are still there. Market conditions favor investors looking for value. Technology makes finding leads easier than ever before. With dedication, you can navigate the process. You can build a successful real estate business. You can start today, even without a lot of cash in your pocket. It is about effort, knowledge, and connecting the right people with the right properties.

Frequently Asked Questions

Do I need a real estate license to wholesale?

In most places in the United States, you do not need a license to wholesale. You are not selling the property itself. You are selling your right to buy the property (the contract). However, some states are adding rules. Always check the specific laws where you plan to wholesale. Being licensed can give you more options, but it is not required for the basic assignment strategy in many areas.

How much money can I make wholesaling?

Your profit is the difference between what your end buyer pays for the contract and what you agreed to pay the original seller. This is your assignment fee. It can range from a few thousand dollars to $10,000 or more per deal. It depends on the property and how good a deal you negotiated.

What is an assignment fee?

This is the fee the cash buyer pays you for assigning your contract to them. It is your responsibility to find the deal, get it under contract, and find the buyer.

How long does a wholesale deal take?

Typically, wholesale deals are fast. Once you have a property under contract, you usually aim to close within 15 to 45 days. The speed is attractive for both the motivated seller and the cash buyer.

Is wholesaling legal in 2025?

Yes, the basic practice of assigning contracts is legal in most places. However, laws vary. Some places have rules about how you can advertise or how many deals you can do without a license. Always check with a local real estate attorney to be sure you are following the rules in your market.

Is wholesaling risky if I don’t use my own money?

The financial risk of losing your own capital is extremely low because you don’t buy the house. However, there is a risk of wasting your time if you can’t find a buyer. There is also a legal risk if you don’t follow local laws or if your contract is not written correctly. Educate yourself and get good advice.