News & Blogs

Home/Blogs

What Is CMA in Real Estate? A Complete Guide

- Real Estate Industry

- # October 3, 2025

- # 469 Views

Buying or selling a home is often the largest financial transaction in a person’s life. Getting the price right is the single most important part of that process. If you set the price too high, your home sits unsold for months. In case you set it too low, you lose money you should have kept. This is why knowing how to calculate value is essential. This is where the Comparative Market Analysis, or CMA, becomes your best friend.

A CMA in real estate is a detailed report. Real estate professionals create this report to estimate a property’s true market value. It looks at similar homes that have recently sold nearby. Agents use this data to give sellers a competitive listing price. They also use it to help buyers craft an informed offer.

Understanding the CMA in real estate process gives you a significant advantage. In this guide, we will take you step-by-step through the entire method.

Table of Contents

What Does CMA Stand for Real Estate?

The term CMA stands for Comparative Market Analysis. It is not a formal appraisal. Instead, it is an opinion of value based on current market activity. A licensed real estate agent or broker performs a CMA. They use recent sales data to find the most likely selling price for a home.

The concept behind a CMA is simple. A buyer will likely not pay more for a house than they would for a very similar home nearby. This similar home is called a ‚Äúcomparable sale,‚ÄĚ or a ‚Äúcomp.‚ÄĚ The core of any CMA in real estate involves finding the best comps.

The Core Purpose

The question of why CMA is important in real estate has a clear answer. It provides essential realism in a volatile market. Without a CMA, pricing a home is just guessing. Guesses often lead to costly mistakes.

CMA for Home Sellers vs CMA for Buyers

Real estate agents use Comparative Market Analysis for two main groups. These groups are sellers and buyers. This highlights the importance of the Comparative Market Analysis real estate procedure.

For sellers, the goal is to set the optimal listing price. Pricing a home too high scares off potential buyers. Those buyers will simply choose a different home. Pricing too low means the seller leaves money on the table. A strong CMA helps the seller find the sweet spot. This spot maximizes profit while attracting quick offers.

For buyers, the goal is to avoid overpaying. If a buyer loves a house, they might be tempted to offer too much. A CMA in real estate report from their agent shows them the house’s true market value. This ensures they make a competitive offer that is grounded in fact. When you need clear, factual data for a smart investment, trust the experts. StreamlineREI provides market insights that give you the confidence to move forward.

How Do You Do a CMA (Comparative Market Analysis Real Estate)?

Whether you are a buyer, seller, or new agent, the steps remain the same. The process is systematic. It relies heavily on finding the right comparable properties.

Step 1: Gather Detailed Property Information

If you want to dive into the market data first, it is important that you have a complete understanding of the property which is called the subject property. You must gather all the significant features of the subject property. The features should cover the location, the number of bedrooms, and the number of bathrooms.

In addition, they should cover the house’s square footage, the year it was built, and the lot size. Be sure to include any significant changes, such as a new roof, a recently remodeled kitchen, or a basement that has been finished. The more in-depth the information is, the better the resulting CMA will be.

Step 2: Research Comparable Properties (Comps)

Finding comparable sales is the main issue of the Comparative Market Analysis (CMA) project. You must track at least three-fifteen sales with comparable data. These houses must be sold with a closed deal lately.

Ideally, they should have been sold in the last three to six months. Properties with a long sales history may not be accurate enough when it comes to representing the present market.

Finding Good Comps

- Proximity: If you want to find comparable properties similar to the subject property, you should look for properties as close as possible. It is always a clever idea to limit your search for comparable properties within the same neighborhood or subdivision.

- Time: Focus on homes sold most recently. If the market is changing fast, use sales from the last 90 days only.

- Physical Features: Comps must be similar in size, age, and style. Do not compare a modern ranch home to a historic Victorian house. The square footage should be within 10 to 15 percent of the subject home. The number of beds and baths should also be nearly identical.

Step 3: Make Adjustments for Differences

No two homes are the same. Even two identical houses built on the same street will have differences. One might have a pool. The other might have a newer HVAC system. The CMA analyst must adjust the comp’s sale price to reflect these differences. This is where the skill of the agent truly matters.

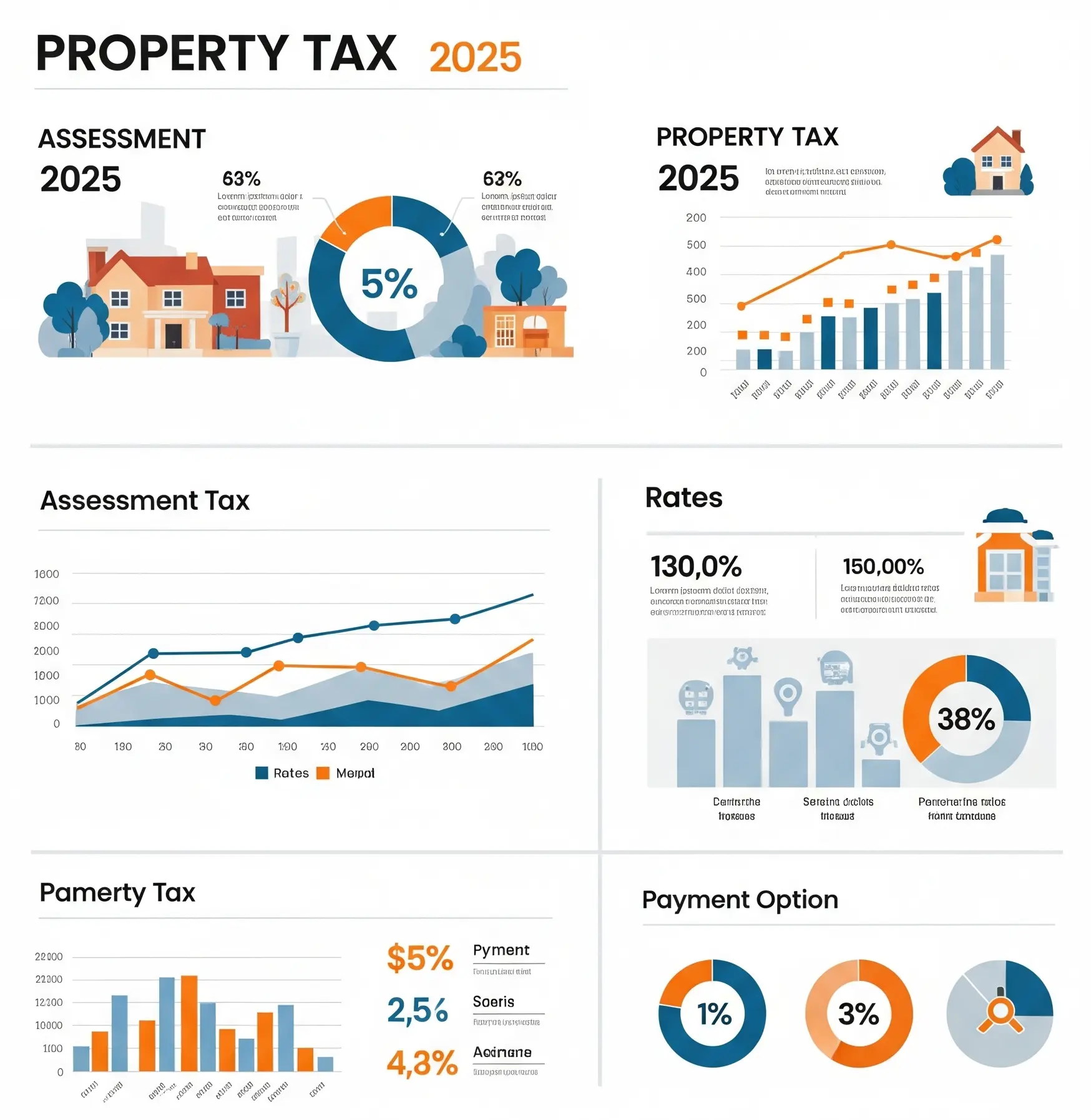

CMA Calculation in Real Estate

The adjustment process ensures you are comparing apples to apples. This is the mathematical core of the Comparative Market Analysis. When using a comp, you adjust its price based on differences from the subject property.

The rules are simple. If the comp has something better than the subject property, you subtract the value of that feature from the comp’s sale price. If the comp has something worse, you add the value of that difference to the comp’s sale price.

Typical features that require adjustments include:

- Bedrooms and Bathrooms

- Garage

- Upgrades

- Lot Size

The final price arrived at after these adjustments is the adjusted sales price. You repeat this for all three to five comparable properties. This process helps you determine the most accurate CMA in real estate value.

Step 4: Determine a Final Price Range

Once all the comparable sales are adjusted, you have a set of adjusted sale prices. For instance, your three comps might have adjusted prices of $455,000, $460,000, and $465,000. This gives you a narrow, evidence-based price range.

The agent uses this range to advise the seller on the best listing price. Listing at the lower end often attracts multiple offers and speeds up the sale. Listing at the higher end might require more time on the market.

CMA vs Appraisal Real Estate

One of the most common questions people ask is about the difference between a CMA and an appraisal. Both aim to determine a property’s value. However, the differences are huge in terms of purpose, who performs them, and their legal weight.

The Purpose and Authority

The CMA vs appraisal real estate comparison starts with their purpose.

- Comparative Market Analysis (CMA): This is a tool for pricing and negotiation. It determines the price the home should be listed for to attract a buyer in the current market. It is an opinion provided by an agent, not an official valuation.

- Property Appraisal: This is a formal, unbiased, and legally recognized valuation of the home’s value. Lenders always require an appraisal. It ensures the house is worth the amount of money the bank is lending to the buyer.

Who Performs the Report?

A state-licensed or certified appraiser performs the official appraisal. Appraisers follow the Uniform Standards of Professional Appraisal Practice, or USPAP. Their training is highly specialized. Appraisers must remain completely impartial, while an agent has an interest in the transaction closing.

How Long Is a CMA on a House Good For?

The market changes quickly. A buyer today may be gone tomorrow. Interest rates and inventory levels shift constantly. This rapid change is usually only three to six months.

The data used in a CMA relies on recent sales. If the market is accelerating, a sale from six months ago might already be outdated. In a slow or changing market, three months is a better limit.

Comparative Market Analysis Tool and Best Practices

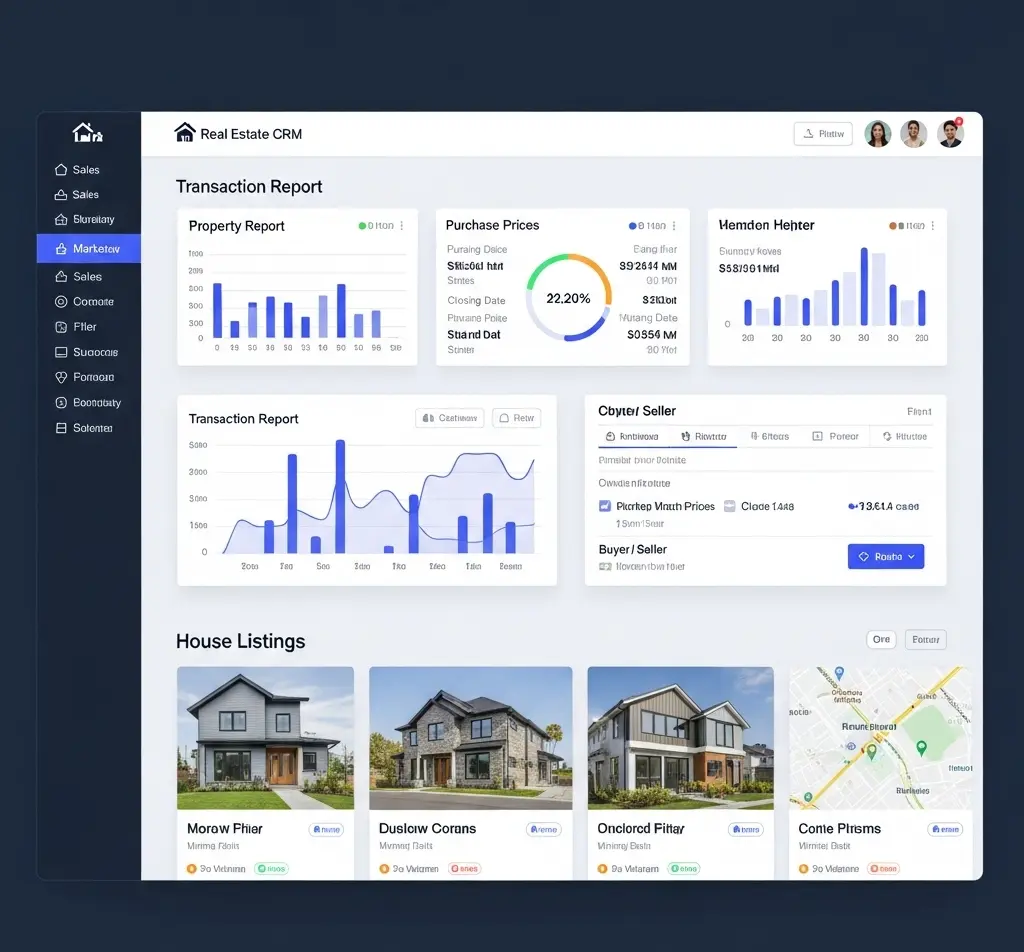

A good real estate agent combines knowledge and modern software. They use several tools to produce a strong CMA. The core tool remains the local MLS, which has the most accurate sold data.

Best Tools for CMA in Real Estate

In addition to the MLS, many software programs assist agents. These tools automate the data collection part of the job.

- Cloud CMA by Lone Wolf

- Realtors Property Resource (RPR)

- PropStream

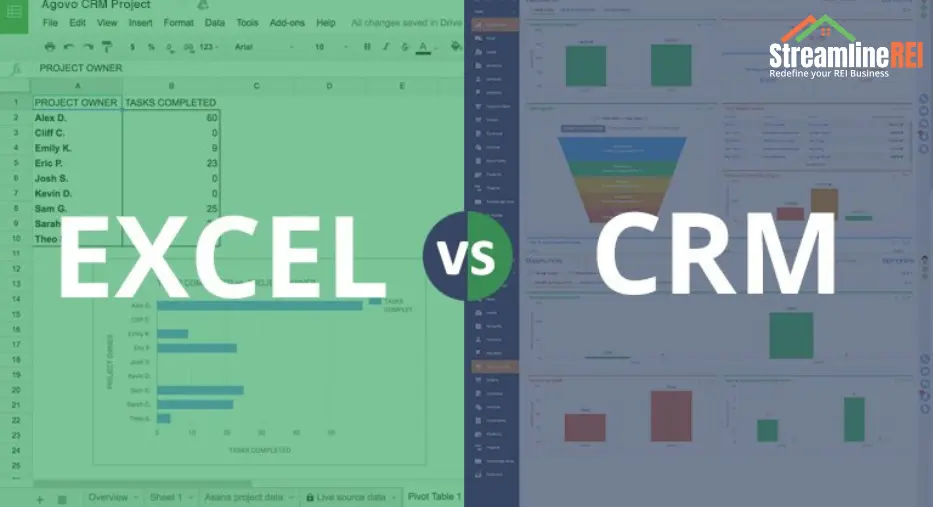

Automated CMA vs Manual CMA Real Estate

There is a big difference between a manual CMA and an automated valuation model, or AVM.

An Automated CMA is a computer-generated value, like the Zillow Zestimate. These models use public records and recent sales data. They provide a quick, general idea of value. They are useful for checking neighborhood trends.

A manual CMA, done by a human agent, is much better. The agent physically visits the home. They look at the view, the light, and the overall feel of the house. A machine cannot account for a messy neighbor’s yard or the sound of traffic nearby. A real agent adjusts for these important details. The human element makes the manual CMA far more accurate.

CMA Real Estate for Home Sellers

When a realtor sits down with a seller, the CMA is the central document. It guides the entire listing strategy.

CMA Real Estate for Buyers and Investors

Buyers and investors need to know the true worth of a property before making an offer. This is where the CMA works backward.

The buyer’s agent conducts a comparative market analysis property appraisal to justify the offer price. If the buyer wants to offer $475,000, the CMA must support that number. If the CMA shows that similar homes only sold for $460,000 after adjustments, the buyer should adjust their offer downward.

This analysis is also crucial for investors. They must calculate the After-Repair Value, or ARV. Investors use a CMA to estimate what the house will be worth after they renovate it.

It is easy to get lost in the details when analyzing a market. For clear, actionable investment analysis, look to StreamlineREI. They turn complex data into simple, profitable strategies.

Final Words

Comparative Market Analysis is really the basis of efficient property pricing. It eliminates the need for speculation when dealing with one of the most important things in life. The CMA gives you the truth, no matter if you are a seller who wants to sell the family house that you have been living in for a long time or a buyer who is going to make the first offer.

A well-executed CMA in real estate report translates to a quicker, smoother, and more profitable transaction. Always trust a professional agent who understands how to do a CMA in real estate with accuracy and integrity. Using this guide, you now know what a CMA is, how it is made, and why it is so powerful.

FAQs

Is a CMA in real estate free?

Yes, a Comparative Market Analysis is typically a complimentary service. Real estate agents offer it free of charge to potential sellers. It is a way for them to win your business and demonstrate their expertise.

What are the three most important things in a CMA?

The three most critical factors in a CMA are:

Location

Time

Features

How do you do a CMA if there are no recent sales?

If there are no recent sales, the agent must expand their search radius. They may need to look at sales from seven to twelve months ago. They must make larger adjustments for market shifts and time. They can also use current pending sales for general market direction. In very rural areas, this challenge is common.

Can a buyer ask for a CMA?

Yes, absolutely. A buyer should always ask their agent to perform a CMA on any property they want to make an offer on. This helps the buyer determine a fair offer price. It also ensures they do not overbid.

What is the most important factor in a comparative market analysis?

The most important factor is the sale date of the comparable properties. The most recent sales provide the best evidence of current market value. In a rapidly changing market, a home sold last week is much more relevant than one sold six months ago. Location is also critical, but recent sales show what buyers are paying for right now.

Is a Comparative Market Analysis the same as an appraisal?

No, they are not the same. A CMA is an informal estimate of the likely selling price, created by a real estate agent. An appraisal is a formal, legally recognized valuation of the property’s value, conducted by a licensed appraiser. Lenders require appraisal. The CMA is a tool for setting the listing price.

Does a property appraisal always come in higher than the CMA?

Not necessarily. A skilled agent will perform the CMA aiming to land a price very close to what they expect the appraisal to be. If the listing price is significantly higher than the CMA range, the appraisal might come in lower. This is called an appraisal gap. It often causes delays or failure in the sale process.