News & Blogs

Home/Blogs

9 kinds of Business Taxes that Apply to Rental Properties

- Real Estate Industry

- # January 29, 2026

- # 469 Views

Every business is required to pay taxes to the federal, state, and local governments. However, there are numerous kinds of taxes. Do you know which taxes your rental property business is supposed to pay? As the business owner, it is your responsibility to fulfill all the tax requirements related to your business. In this blog, you’ll find a list of the various kinds of taxes that your real estate investment business may be eligible for.

Table of Contents

Federal Taxes

There are four types of taxes that you need to be aware of at the federal level.

1) Income Taxes

When your business starts generating income, you need to pay income taxes based on the earnings, both at the federal and state levels. The type of business structure you have will determine how you pay income taxes.

- Sole Proprietorship – Sole proprietorships pay income taxes at the individual level. You will file Form 1040 to report these taxes.

- Partnerships and S Corporations – Rental property businesses that are partnerships or S corporations file separate tax returns to report business income or losses. You will first report your income or losses at the business level. However, a partnership or S corporation does not pay federal income taxes at the business level. You will report your income or losses on your individual Schedule K-1 forms. The taxes due will then be calculated based on the tax bracket that you fall under.

- C Corporations – As a shareholder of a C corporation, you will face situations like paying income taxes twice, once at the corporate level and again at the shareholder level. The taxes are calculated based on the net income of the business. When the shareholders receive dividends, they are taxed on the shareholder’s tax return.

2) Estimated Taxes

Estimated taxes for businesses are due quarterly. If you organized your rental business as a C corporation, and you expect to own more than $500, you are required to pay estimated taxes.

For all other types of businesses, you are required to pay estimated taxes if the taxpayer is likely to owe more than $500 on their personal tax return.

Create a few reminders for your estimated tax payments for 2023:

- January 17, 2023

- April 18, 2023

- June 15, 2023

- September 15, 2023

- January 16, 2024

If the due date is a holiday or a weekend, you must file your taxes on the next business day.

3) Self-Employment Taxes

Rental real estate investment is generally treated as passive income, which is not subject to self-employment tax.

You must report self-employment income if your business income exceeds $400. Your earnings will be taxed at the self-employment rate. The self-employment tax rate for 2023 is 15.3%. This is composed of 12.4% for Social Security and 2.9% for Medicare taxes.

But if you render significant additional services, you may be eligible for self-employment taxes. As you are self-employed, you will pay both the employee and employer portions of Social Security and Medicare taxes. Consult with your financial advisor to determine if you are liable for self-employment taxes.

4) Employment Taxes

Do you have employees in your rental property business? If so, you are required to pay employment taxes at both the federal and state levels. These taxes are comprised of both the employer’s portion and the portion deducted from the employees’ wages. They consist of the following.

- Social Security and Medicare Taxes – 12.4% combined total of both employee and employer portions

- Federal and State Income Taxes Withheld – Varies depending on the employees’ W-4 allowances

- Federal Unemployment Tax – 6% of the first $7,000 of income for each employee

- State Unemployment Tax – Varies depending on the state and may be different from the federal tax rate

State and Local Taxes

The state taxes you are required to file depend on where you live or where your properties are located. These five types of taxes are the ones your rental property business will most likely be eligible for.

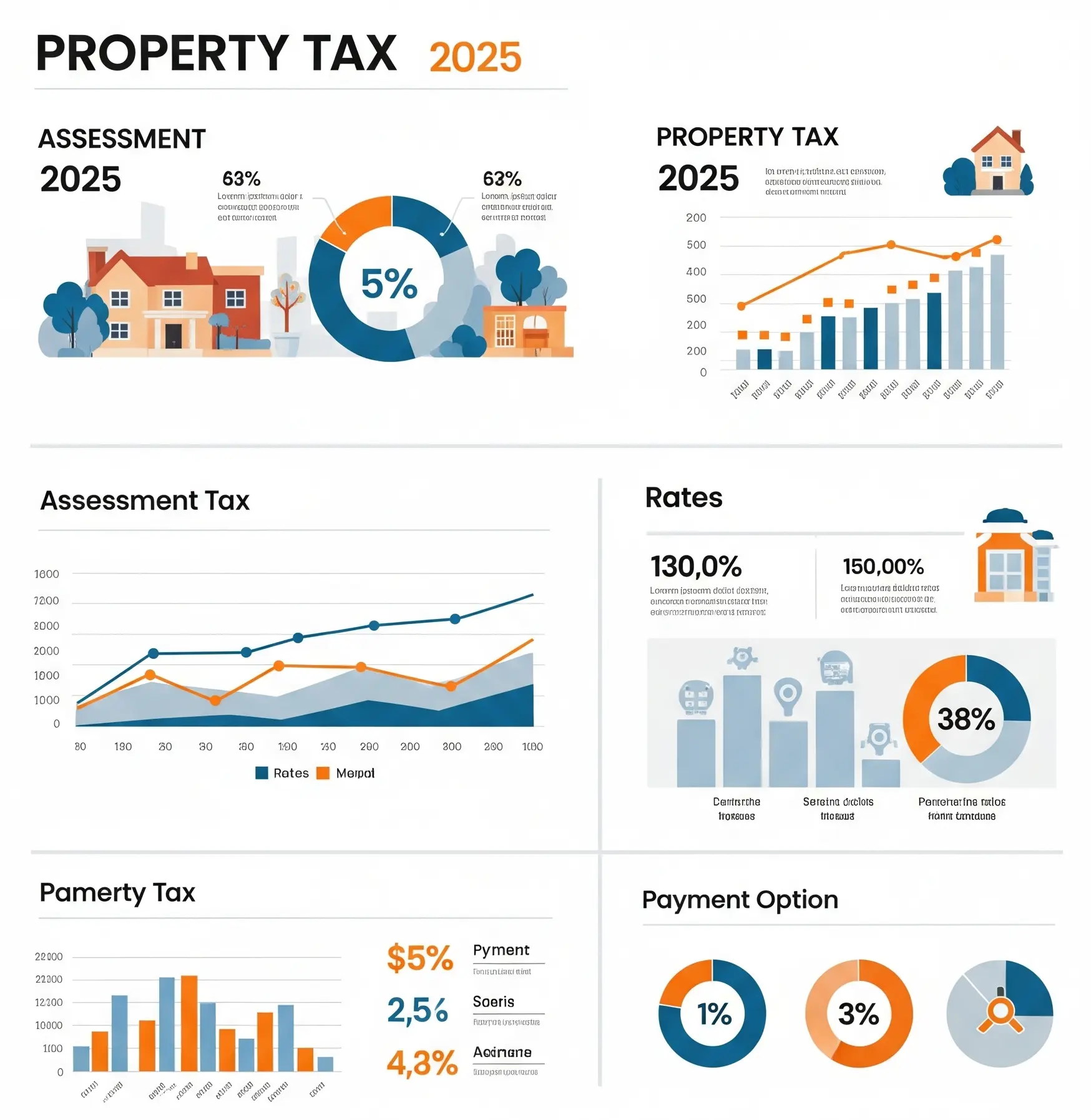

5) Property Taxes

If you own a business with real estate, you will be required to pay property taxes. These taxes are calculated by multiplying the property tax rate by the percentage of the value of the property that is subject to taxation. This is not to be confused with the fair market value of your property.

When you purchase a property, you will be required to register it with the state or local government. Once you have done this, you will be notified of any changes in the assessed value of the property. This is what your taxes will be based on.

6) Business Personal Property Taxes

If you own fixed assets for your rental property business, you will be required to file business personal property taxes. Consider some of the items on your balance sheet, such as furniture, fixtures, computer equipment, machinery, tools, and heavy equipment.

These are the items that you will pay business personal property taxes on. Even if your assets are fully depreciated, some states will require you to pay taxes on them every year.

7) Transient Occupancy Taxes

If you are engaging in short-term rentals (typically 30 days or less), then you may needto pay transient occupancy taxes. This is not limited to hotels, inns, or hostels. Rental homes, cabins, boarding houses, guest rooms, and other types of rented accommodations are all included. Therefore, if you are a house hacker, vacation rental entrepreneur, or Airbnb entrepreneur, then you will need to check with your tax professional about this tax.

8) Short-Term Rental Taxes

It is up to your local government to decide what constitutes a short-term rental for tax purposes. In some cases, a short-term rental can be up to 92 days in a row. In some cases, you will need to be certified as a short-term rental business before opening, and then again, every year. Your attorney and tax professional can assist you in determining what the requirements are in your area and whether this tax applies to you.

9) Sales Taxes

If your rental property business provides any other services, you may need to pay sales taxes. Consider these scenarios.

- You provide commercial building maintenance, such as cleaning or janitorial services, as part of your rental agreement.

- Your real estate investment property is a parking lot.

- You provide meals for your rentals.

- You provide guided tours.

- Your rental agreement includes lawn maintenance.

- Your rental agreement allows you to charge for repair services and materials.

The rates for sales taxes differ by state and by locality. The requirements will be different. Check with your tax professional to see what the requirements are in your area and if they apply to your business.

Conclusion

Regardless of what taxes you owe on your rental property, it is your duty to pay the taxes as the owner of the business. First, you need to consult with your CPA to figure out what taxes you owe. Then, make a schedule so you won’t miss the deadline for filing your taxes. Be prepared with all the documents you need and check your deductions and credits with StreamlineREI. If you are proactive and organized, your real estate investment business will be ready for any tax deadline.

Frequently Asked Questions

What kind of taxes are normally paid by rental businesses?

Rental businesses may be liable for federal income taxes, estimated taxes, employment or self-employment taxes, property taxes, sales taxes, and local short-term rental or occupancy taxes.

Do owners of rental income pay self-employment tax?

Passive income from rental sources is normally not subject to self-employment tax, but real estate professionals or owners who provide significant services may be liable for it.

What are transient occupancy and short-term rental taxes?

These are local taxes imposed on short-term stays, usually less than 30 to 90 days, such as Airbnb or vacation rentals, and may require separate registration.

Are property owners liable for furniture and equipment taxes?

Yes. Many states impose business personal property taxes on items such as furniture, computers, equipment, or machinery used in rental businesses.

When are taxes due for rental businesses?

Estimated federal taxes are normally paid quarterly, if you expect to owe more than $500, with due dates throughout the year.