News & Blogs

Home/Blogs

Real Estate Accounting: A Complete Guide for Investors and Agents

- Real Estate Industry

- # August 27, 2025

- # 469 Views

It is exciting to buy, sell, or manage real estate, but even the best real estate deals can turn into costly mistakes if you don’t manage your money well. Real estate accounting is therefore more than simply keeping records. It involves developing a system that helps agents and investors in monitoring cash flow, eliminating useless spending, claiming all available tax deductions, and determining the actual profitability of their properties.

Accounting ensures that your rental income becomes long-term wealth for investors. It helps agents in managing their tax responsibilities, business expenses, and commission structure. Simply put, the answer to the most asked question, “Is accounting useful for real estate?” is simple: it’s the foundation of becoming financially successful in the real estate sector.

Table of Contents

What is Real Estate Accounting?

Real estate accounting is the process of documenting, categorizing, and evaluating all financial transactions pertaining to real estate.

It includes everything from:

- Commissions, security deposits, and rental income.

- Property taxes, insurance premiums, and mortgage payments

- Upkeep, fixes, and capital enhancements.

- Investment gains, 1031 exchanges, and real estate sales.

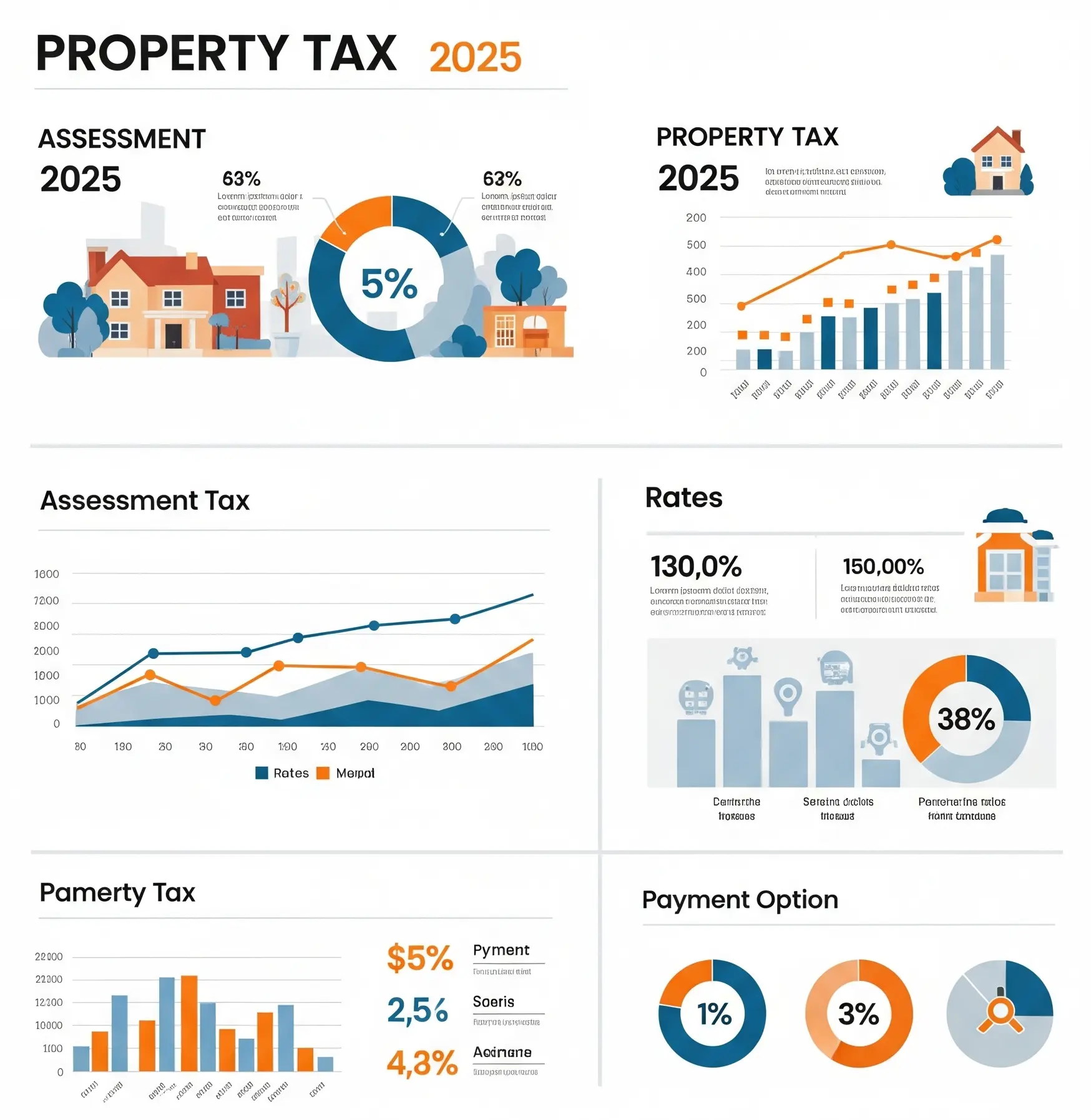

Real estate accounting is subject to special regulations, compared to general accounting. For example, depreciation enables investors to lower their annual taxable income even when the market value of their property increases. Agents can maximize their tax deductions by keeping track of their marketing expenses, such as fuel, open house costs, and advertisements.

Why Accounting is Key for Real Estate?

Accounting isn’t just limited to crunching numbers be it an investor, agent, or project manager. Accounting is key to making smart and profitable decisions in your business.

Improved Cash Flow Management

Know exactly the amount of money coming in from sales or rent and where it is going.

Better Tax Strategies

Accurate documentation tells you about deductions for depreciation, maintenance, property taxes, and mortgage interest.

Improved Decision-Making

Examine ROI at the property level and compare it with the most lucrative assets.

Increased Credibility

Before authorizing loans or partnerships, lenders and investors look for clear financial statements.

Compliance & Audit Readiness

Proper bookkeeping ensures that you’ll be ready if any IRS or tax authorities come knocking.

To put it simply, real estate success and accounting are completely linked.

Bookkeeping for Real Estate Industry

Bookkeeping is the basis of every financial system, enabling you to keep track of complete income and expenses. Good bookkeeping gives investors and agents clarity on performance and simplifies tax filing.

Key practices include:

Dedicated Bank Accounts: Maintain distinct accounts for capital reserves, security deposits, and operating costs.

Chart of Accounts: Reports are organized using categories such as rent, property taxes, repairs, commissions, and mortgage interest.

Expense classification: distinguish between capital improvements (new roof, renovations) and routine operating costs (maintenance, utilities).

Recordkeeping: Keep track of invoices, receipts, and digital documents because many tax deductions need documentation.

A lot of professionals forget about car expenses. Mileage tracking is another crucial expense if you’re an investor showing properties or an agent driving to listings.

Accounting Methods You Can Use for Real Estate

The key to compliance and clarity is selecting the appropriate accounting method. The two primary choices are:

Cash Basis Accounting

- Keeps track of earnings as they are received and outlays as they are paid.

- It is easy to use, mimics actual cash flow, and is IRS-approved for most landlords.

- Ideal for individuals and small investors.

For example, rent paid on January 2 but due on December 30 is recorded in January.

Accrual Basis Accounting

- Keeps track of earnings as they happen and outlays as they happen, whether or not they are paid.

- Provides a more realistic picture of future commitments and profitability.

- Ideal for brokerages, property management companies, and extensive portfolios.

For example, rent that was paid on January 2 but was due on December 30 is still listed in December.

IRS Guidance and Choosing the Right Method

- Unless your company’s gross receipts average more than $25 million, the IRS permits cash basis.

- Smaller operations and simplicity are best served on a cash basis.

- Accrual basis works well for growing companies that require precise forecasts.

As their portfolio expands, many investors switch from cash basis to accrual.

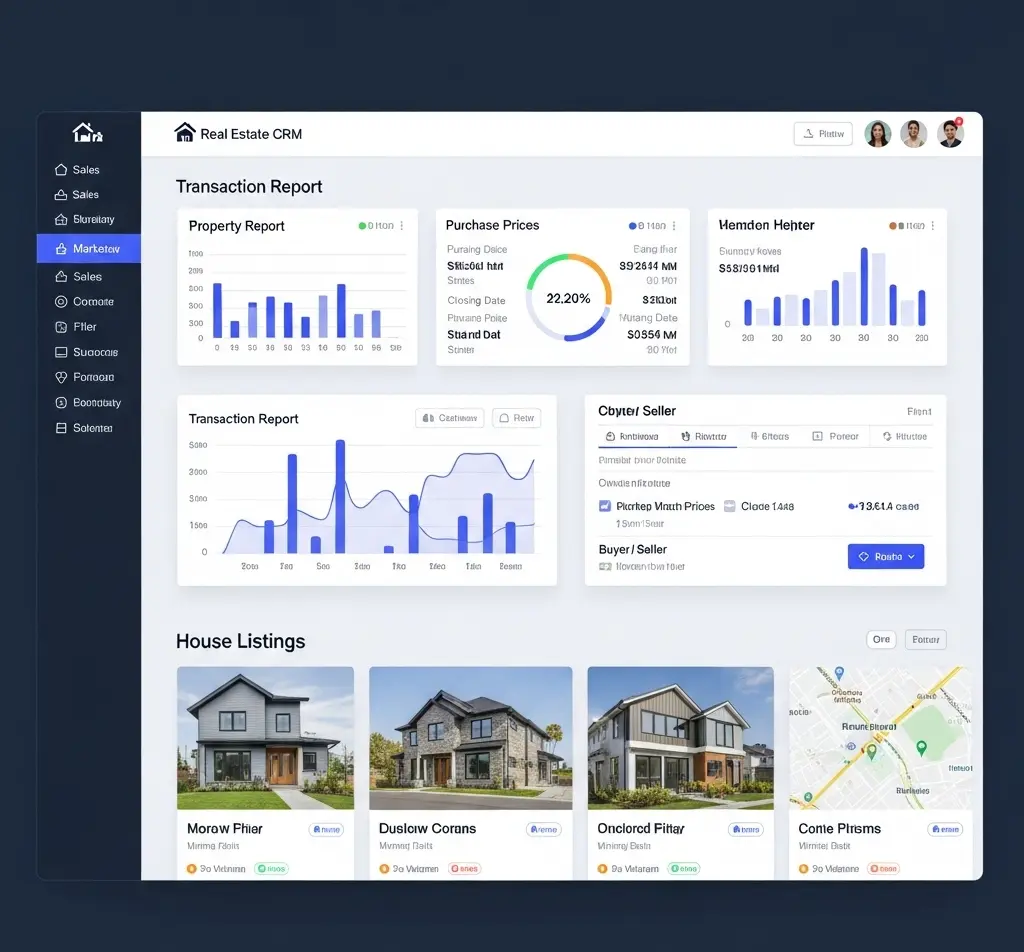

Real Estate Accounting Software

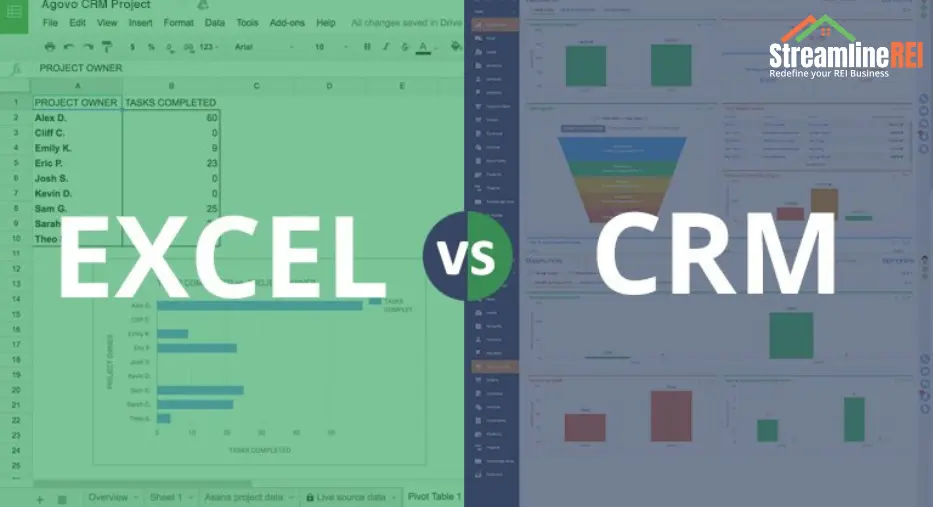

For beginners, manually recording everything in spreadsheets works, but it soon becomes too much to handle. Accounting software for real estate investing becomes vital in this situation.

When looking for an accounting software, make sure it has these standard features:

- Automated income recording and rent collection.

- Expense classification by property.

- ROI reports and financial dashboards.

- Tax-ready reports (depreciation schedules, Schedule E).

- Mobile access for on-the-go expense tracking.

Some of the popular choices that are used by industry leaders are:

QuickBooks: Adaptable, but real estate customization is needed.

Stessa: Free features like balance sheets and P&L are available to investors.

Buildium and AppFolio are two excellent tools for property managers who manage several units.

For small landlords, Landlord Studio is a highly intuitive and user-friendly software.

Choosing a suitable tool starts with examining your portfolio size and number of agents. Individual investors can start with Landlord Studio or Stessa; however, big firms should consider Buildium or AppFolio for more customization.

Best Practices for Accounting & Real Estate Professionals

You should adopt these best practices to maximize efficiency in your real estate accounting.

Automate where possible. Sync bank accounts with accounting software to reduce manual entry. Ensure statements match bank records to avoid errors. Make a plan to review finances quarterly or biyearly. Monitor net operating income (NOI), ROI, and property-specific cash flow. Plan your taxes beforehand. Don’t wait until April. Set aside funds monthly for tax obligations. Collaborate with accounting experts. A CPA who understands real estate can implement advanced strategies like cost segregation and 1031 exchanges.

Common Mistakes to Avoid

Even experienced investors and agents make errors. Avoid these common mistakes to stay ahead.

- Mixing personal and business funds.

- Ignoring small expenses (which add up at tax time).

- Failing to record depreciation.

- Not preparing for irregular costs (repairs, vacancies).

- Relying on spreadsheets too long instead of upgrading to accounting software.

Final Thoughts

Real estate accounting is the foundation of smart investing and long-term company growth, and it goes far beyond tax compliance. Investors and agents can increase returns, reduce risks, and make better decisions with the help of real estate investing accounting software, proper bookkeeping, and a clear understanding of real estate accounting.

So, is real estate accounting useful? Definitely. Not only is accurate financial tracking helpful, but it is also a must to streamline your transactions. With the correct accounting system, you can be sure that you’re improving your processes and becoming long-term profitable.

FAQs

Which accounting method is best for real estate?

Small investors often use cash basis accounting, while larger portfolios and agencies benefit from accrual accounting for detailed tracking.

Is accounting useful for real estate investors and agents?

Yes, accounting helps track cash flow, reduce tax liabilities, and improve decision-making, making it essential for long-term profitability.

What is bookkeeping for real estate?

Bookkeeping for real estate involves recording daily transactions like rent payments, maintenance costs, commissions, and property-related expenses.

What is the best real estate investing accounting software?

Popular options include QuickBooks, Buildium, and AppFolio, which help automate bookkeeping, reporting, and compliance for investors and agents.

How does accounting support real estate growth?

By ensuring accurate records, identifying profitable opportunities, and reducing financial risks, accounting enables investors and agents to scale effectively.